Beneficial Ownership Information Report

This reporting mandate begins January 1, 2024!

Not sure what your responsibilities are for the new beneficial ownership information report? Nubus can help.

- Ensure compliance with this new federal mandate

- Securely submit your information with expert guidance

- Stay in compliance with automated reminders

Ready To File Your BOI

Report?

Starting December 15th, 2023, Nubus can facilitate filing the BOI report on behalf of your business or your client’s business.

If you already have an existing company with Nubus, the new BOI report will be available this year! If you want the report added to your existing suite of services, follow these 3 easy steps:

- Let us know if you’re interested by filling out this form. Even if your company is not currently active, please fill out the form and Nubus will confirm if you’re exempt from filing a BOI report. From there, our team of business filing experts will contact you to discuss the next steps and collect all necessary information.

- Start gathering all the necessary information. Here’s a list of the required information we will request, some of which we may already have.

Applicant or beneficial owner information: Legal full name, date of birth, residential or business street address, and personal identification document with a unique identifying number, like a driver’s license or passport.

Company information: Legal company name, any DBAs or trade names, business address, formation jurisdiction, and identification including Taxpayer Identification Number, Social Security Number, or Employer Identification Number (EIN).

- Spread the word to other business owners. This new report is a FinCEN requirement, and if not filed by the due date, it comes with fines and criminal consequences.

What is a

Beneficial Owner Information Report?

In September of 2022, the Financial Crimes Enforcement Network (FinCEN) issued a final rule implementing the bipartisan Corporate Transparency Act’s (CTA) beneficial ownership information (BOI) report.

The rule will enhance the ability of government agencies to protect national security and financial systems from illicit use and help prevent drug traffickers, fraudsters, and other criminals from laundering or hiding money in the United States.

The new rule describes who must file a BOI report, what information must be reported, and when a report is due. Specifically, the rule requires Corporations and Limited Liability Companies to file reports that identify the beneficial owners of the entity and the company applicants of the entity.

Key BOI dates to be aware of:

- FinCEN will begin accepting BOI reports on January 1, 2024

- New businesses that are formed on or after January 1, 2024, must file within 90 days of business formation

- Existing businesses that were formed before January 1, 2024, must file before January 1, 2025

Who Needs To File A BOI Report?

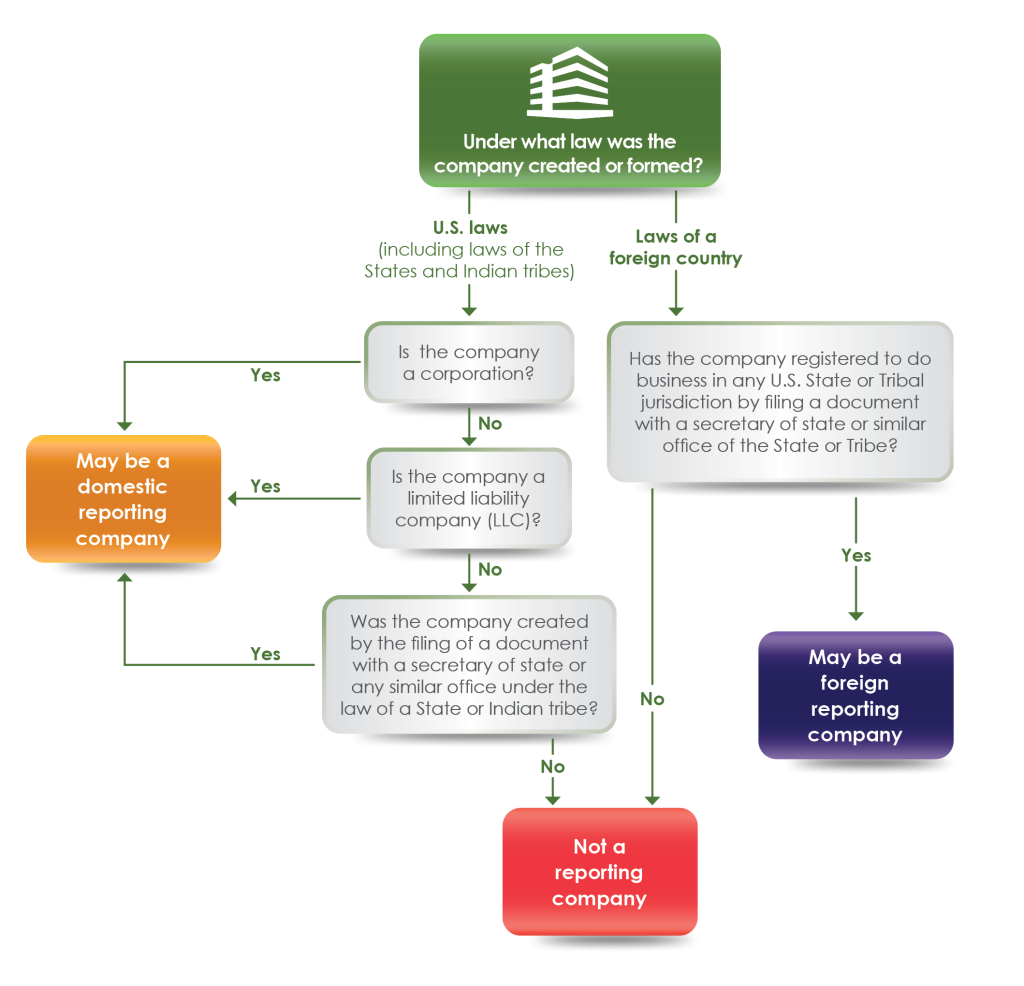

The rule identifies domestic and foreign as the two types of reporting companies that must file a report.

- A domestic reporting company is a Corporation, Limited Liability Company (LLC), or any entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

- A foreign reporting company is a Corporation, LLC, or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office. Under the rule, and in keeping with the CTA, twenty-three types of entities are exempt from the definition of “reporting company.”

FinCEN expects that these definitions will also include Limited Liability Partnerships, Limited Liability Limited Partnerships, Business Trusts, and most limited Partnerships, because such entities are generally created by a filing with a secretary of state or similar office.

Beneficial Owner Information Report FAQs

We specialize in US tax and accounting services for foreign digital entrepreneurs across the globe.

Top notch customer service and the maximum possible tax savings for you and your business

WE HANDLE TAXES FOR INTERNATIONAL ENTREPRENEURS

BETTER THAN ANYONE ELSE!

If you are looking for personalized, top notch customer service and the maximum possible tax savings for you and your business, you’ve come to the right place.

WHAT PEOPLE ARE SAYING ABOUT US

WE ARE READY TO HELP YOU TAKE CARE OF BUSINESS!

Please fill out the form below and we will reach out to you within 24 hours during regular business hours. If your form is submitted over the weekend or during a major US holiday we will contact you the next business day.